Everything about Custom Private Equity Asset Managers

Wiki Article

The Main Principles Of Custom Private Equity Asset Managers

(PE): spending in business that are not openly traded. Roughly $11 (https://cpequityamtx.weebly.com/). There might be a few things you do not comprehend about the industry.

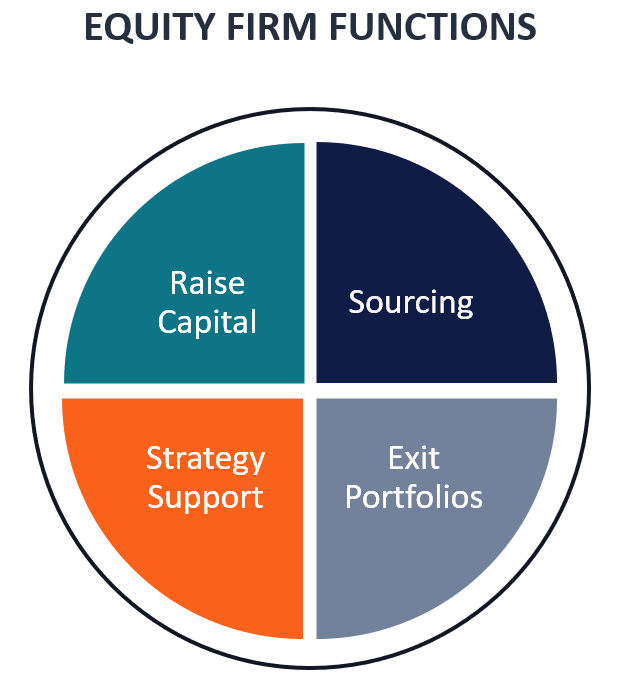

Companions at PE companies elevate funds and handle the money to produce positive returns for investors, usually with an financial investment horizon of between four and seven years. Private equity firms have a range of financial investment choices. Some are stringent sponsors or passive financiers completely reliant on management to grow the business and create returns.

Due to the fact that the most effective gravitate toward the larger bargains, the middle market is a considerably underserved market. There are more vendors than there are highly seasoned and well-positioned money specialists with comprehensive buyer networks and sources to handle a bargain. The returns of exclusive equity are typically seen after a couple of years.

7 Easy Facts About Custom Private Equity Asset Managers Shown

Traveling listed below the radar of big international firms, a number of these tiny firms often give my review here higher-quality client service and/or specific niche product or services that are not being used by the big conglomerates (https://www.imdb.com/user/ur173700848/?ref_=nv_usr_prof_2). Such advantages draw in the passion of personal equity firms, as they have the understandings and wise to exploit such opportunities and take the firm to the next level

Exclusive equity investors have to have reliable, qualified, and trustworthy management in place. The majority of supervisors at portfolio firms are provided equity and incentive payment frameworks that award them for hitting their financial targets. Such alignment of goals is commonly needed prior to an offer gets done. Personal equity opportunities are commonly out of reach for individuals that can't spend millions of bucks, however they should not be.

There are regulations, such as restrictions on the aggregate amount of money and on the number of non-accredited capitalists (Asset Management Group in Texas).

How Custom Private Equity Asset Managers can Save You Time, Stress, and Money.

One more negative aspect is the lack of liquidity; when in a private equity transaction, it is challenging to obtain out of or sell. There is a lack of flexibility. Exclusive equity additionally includes high fees. With funds under monitoring currently in the trillions, personal equity firms have become attractive financial investment automobiles for wealthy people and institutions.

Now that accessibility to exclusive equity is opening up to even more individual investors, the untapped capacity is ending up being a fact. We'll begin with the main arguments for investing in exclusive equity: Exactly how and why personal equity returns have actually historically been higher than other properties on a number of degrees, How consisting of personal equity in a portfolio impacts the risk-return profile, by helping to diversify versus market and intermittent threat, After that, we will detail some key considerations and threats for private equity investors.

When it pertains to presenting a new property into a profile, one of the most standard consideration is the risk-return account of that possession. Historically, exclusive equity has actually displayed returns comparable to that of Arising Market Equities and more than all various other standard possession classes. Its reasonably reduced volatility paired with its high returns produces a compelling risk-return account.

Our Custom Private Equity Asset Managers Ideas

Actually, personal equity fund quartiles have the best series of returns across all alternate possession courses - as you can see listed below. Method: Interior rate of return (IRR) spreads out determined for funds within vintage years separately and afterwards balanced out. Average IRR was determined bytaking the standard of the median IRR for funds within each vintage year.

The takeaway is that fund choice is crucial. At Moonfare, we perform a strict choice and due persistance process for all funds provided on the platform. The result of including exclusive equity into a portfolio is - as always - depending on the portfolio itself. However, a Pantheon research from 2015 suggested that consisting of personal equity in a portfolio of pure public equity can unlock 3.

On the other hand, the best personal equity firms have access to an also bigger pool of unknown chances that do not encounter the same examination, as well as the resources to execute due diligence on them and recognize which deserve buying (TX Trusted Private Equity Company). Spending at the ground floor indicates higher risk, but also for the business that do be successful, the fund advantages from higher returns

Custom Private Equity Asset Managers for Dummies

Both public and personal equity fund managers commit to spending a percent of the fund yet there remains a well-trodden concern with straightening passions for public equity fund monitoring: the 'principal-agent trouble'. When an investor (the 'primary') employs a public fund supervisor to take control of their resources (as an 'agent') they entrust control to the manager while keeping ownership of the possessions.

In the instance of exclusive equity, the General Companion does not simply make a monitoring fee. They also earn a percent of the fund's earnings in the type of "bring" (typically 20%). This guarantees that the passions of the supervisor are lined up with those of the investors. Private equity funds also mitigate an additional kind of principal-agent issue.

A public equity investor eventually desires something - for the administration to boost the stock rate and/or pay returns. The investor has little to no control over the choice. We revealed above the number of private equity techniques - especially bulk buyouts - take control of the operating of the business, making sure that the long-lasting worth of the firm comes initially, pressing up the return on financial investment over the life of the fund.

Report this wiki page